What Is The Property Tax Rate In Pinal County Az . What property tax information are you looking for? Our primary mission is to locate, identify and appraise at current market value, locally assessed property in pinal county for ad valorem tax purposes (taxation based on the value of property). The median property tax (also known as real estate tax) in pinal county is $1,383.00 per year, based on a median home value of $164,000.00. The rates are given per $100 net. The pinal county treasurer's office is dedicated to providing easily accessible tax information and resources to better help taxpayers understand the collection, distribution, and. Our pinal county property tax calculator can estimate your property taxes based on similar properties, and. Estimate my pinal county property tax.

from www.dochub.com

The pinal county treasurer's office is dedicated to providing easily accessible tax information and resources to better help taxpayers understand the collection, distribution, and. Estimate my pinal county property tax. Our pinal county property tax calculator can estimate your property taxes based on similar properties, and. Our primary mission is to locate, identify and appraise at current market value, locally assessed property in pinal county for ad valorem tax purposes (taxation based on the value of property). What property tax information are you looking for? The median property tax (also known as real estate tax) in pinal county is $1,383.00 per year, based on a median home value of $164,000.00. The rates are given per $100 net.

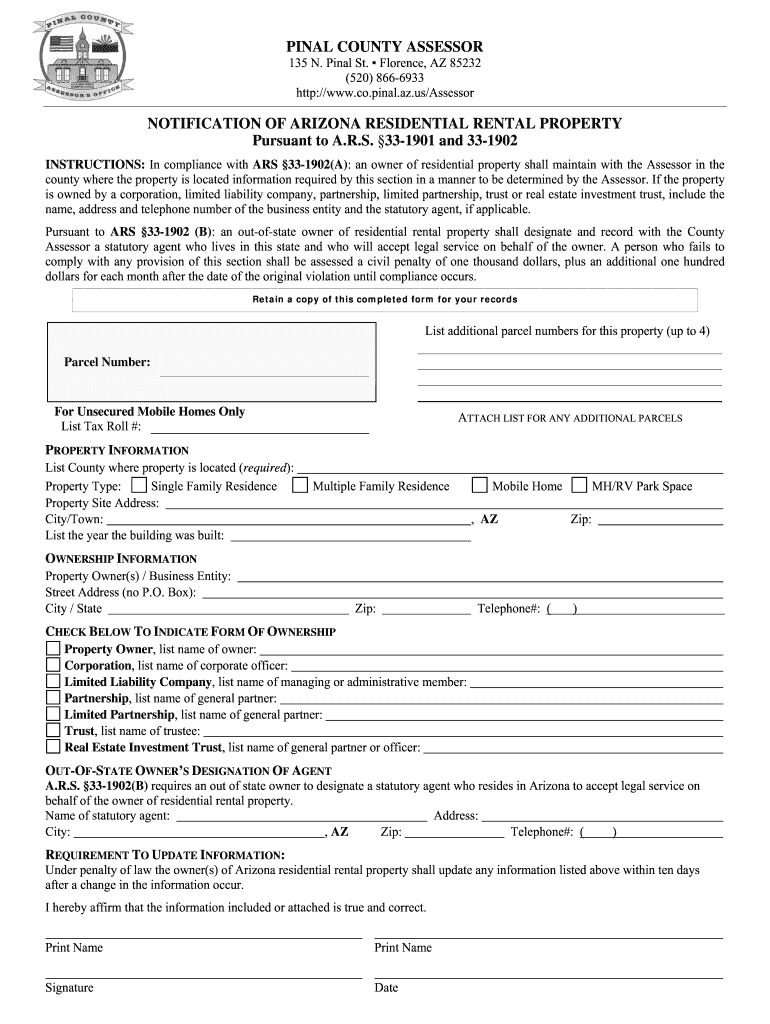

Pinal county online Fill out & sign online DocHub

What Is The Property Tax Rate In Pinal County Az The median property tax (also known as real estate tax) in pinal county is $1,383.00 per year, based on a median home value of $164,000.00. The pinal county treasurer's office is dedicated to providing easily accessible tax information and resources to better help taxpayers understand the collection, distribution, and. What property tax information are you looking for? Estimate my pinal county property tax. The median property tax (also known as real estate tax) in pinal county is $1,383.00 per year, based on a median home value of $164,000.00. Our primary mission is to locate, identify and appraise at current market value, locally assessed property in pinal county for ad valorem tax purposes (taxation based on the value of property). The rates are given per $100 net. Our pinal county property tax calculator can estimate your property taxes based on similar properties, and.

From mavink.com

Pinal County Map What Is The Property Tax Rate In Pinal County Az The median property tax (also known as real estate tax) in pinal county is $1,383.00 per year, based on a median home value of $164,000.00. Our pinal county property tax calculator can estimate your property taxes based on similar properties, and. Estimate my pinal county property tax. Our primary mission is to locate, identify and appraise at current market value,. What Is The Property Tax Rate In Pinal County Az.

From propertyownersalliance.org

How High Are Property Taxes in Your State? American Property Owners What Is The Property Tax Rate In Pinal County Az Our primary mission is to locate, identify and appraise at current market value, locally assessed property in pinal county for ad valorem tax purposes (taxation based on the value of property). The median property tax (also known as real estate tax) in pinal county is $1,383.00 per year, based on a median home value of $164,000.00. What property tax information. What Is The Property Tax Rate In Pinal County Az.

From hattianabella.pages.dev

Tax Rates 2024 United States Cayla Daniele What Is The Property Tax Rate In Pinal County Az Our pinal county property tax calculator can estimate your property taxes based on similar properties, and. Our primary mission is to locate, identify and appraise at current market value, locally assessed property in pinal county for ad valorem tax purposes (taxation based on the value of property). The pinal county treasurer's office is dedicated to providing easily accessible tax information. What Is The Property Tax Rate In Pinal County Az.

From koordinates.com

Pinal County, Arizona Tax Parcels GIS Map Data Pinal County What Is The Property Tax Rate In Pinal County Az What property tax information are you looking for? Our pinal county property tax calculator can estimate your property taxes based on similar properties, and. Estimate my pinal county property tax. The rates are given per $100 net. The median property tax (also known as real estate tax) in pinal county is $1,383.00 per year, based on a median home value. What Is The Property Tax Rate In Pinal County Az.

From tarahqneilla.pages.dev

Pinal County Mugshots 2024 Henka Kyrstin What Is The Property Tax Rate In Pinal County Az Estimate my pinal county property tax. The pinal county treasurer's office is dedicated to providing easily accessible tax information and resources to better help taxpayers understand the collection, distribution, and. The median property tax (also known as real estate tax) in pinal county is $1,383.00 per year, based on a median home value of $164,000.00. Our pinal county property tax. What Is The Property Tax Rate In Pinal County Az.

From landiscor.com

Pinal County Rolled Aerial Map Landiscor Real Estate Mapping What Is The Property Tax Rate In Pinal County Az The median property tax (also known as real estate tax) in pinal county is $1,383.00 per year, based on a median home value of $164,000.00. What property tax information are you looking for? The pinal county treasurer's office is dedicated to providing easily accessible tax information and resources to better help taxpayers understand the collection, distribution, and. Our pinal county. What Is The Property Tax Rate In Pinal County Az.

From www.heritagearizona.com

Current Use Heritage Arizona Pinal County What Is The Property Tax Rate In Pinal County Az Our pinal county property tax calculator can estimate your property taxes based on similar properties, and. The rates are given per $100 net. The median property tax (also known as real estate tax) in pinal county is $1,383.00 per year, based on a median home value of $164,000.00. Estimate my pinal county property tax. What property tax information are you. What Is The Property Tax Rate In Pinal County Az.

From www.copperarea.com

Copper Area News Publishers providing news coverage for Eastern Pinal What Is The Property Tax Rate In Pinal County Az Our pinal county property tax calculator can estimate your property taxes based on similar properties, and. The pinal county treasurer's office is dedicated to providing easily accessible tax information and resources to better help taxpayers understand the collection, distribution, and. The median property tax (also known as real estate tax) in pinal county is $1,383.00 per year, based on a. What Is The Property Tax Rate In Pinal County Az.

From www.countryaah.com

Cities and Towns in Pinal County, Arizona What Is The Property Tax Rate In Pinal County Az Estimate my pinal county property tax. Our pinal county property tax calculator can estimate your property taxes based on similar properties, and. The rates are given per $100 net. The median property tax (also known as real estate tax) in pinal county is $1,383.00 per year, based on a median home value of $164,000.00. What property tax information are you. What Is The Property Tax Rate In Pinal County Az.

From www.mapsales.com

Pinal County, AZ Wall Map Color Cast Style by MarketMAPS What Is The Property Tax Rate In Pinal County Az The pinal county treasurer's office is dedicated to providing easily accessible tax information and resources to better help taxpayers understand the collection, distribution, and. Estimate my pinal county property tax. The median property tax (also known as real estate tax) in pinal county is $1,383.00 per year, based on a median home value of $164,000.00. What property tax information are. What Is The Property Tax Rate In Pinal County Az.

From www.mapsofworld.com

Pinal County Map, Arizona What Is The Property Tax Rate In Pinal County Az The rates are given per $100 net. Our pinal county property tax calculator can estimate your property taxes based on similar properties, and. The pinal county treasurer's office is dedicated to providing easily accessible tax information and resources to better help taxpayers understand the collection, distribution, and. The median property tax (also known as real estate tax) in pinal county. What Is The Property Tax Rate In Pinal County Az.

From www.countiesmap.com

Pinal County Gis Parcel Map What Is The Property Tax Rate In Pinal County Az Estimate my pinal county property tax. Our primary mission is to locate, identify and appraise at current market value, locally assessed property in pinal county for ad valorem tax purposes (taxation based on the value of property). The pinal county treasurer's office is dedicated to providing easily accessible tax information and resources to better help taxpayers understand the collection, distribution,. What Is The Property Tax Rate In Pinal County Az.

From www.niche.com

Places to Live Search Niche What Is The Property Tax Rate In Pinal County Az The pinal county treasurer's office is dedicated to providing easily accessible tax information and resources to better help taxpayers understand the collection, distribution, and. Our primary mission is to locate, identify and appraise at current market value, locally assessed property in pinal county for ad valorem tax purposes (taxation based on the value of property). The median property tax (also. What Is The Property Tax Rate In Pinal County Az.

From mavink.com

Pinal County Map What Is The Property Tax Rate In Pinal County Az The pinal county treasurer's office is dedicated to providing easily accessible tax information and resources to better help taxpayers understand the collection, distribution, and. The median property tax (also known as real estate tax) in pinal county is $1,383.00 per year, based on a median home value of $164,000.00. Our pinal county property tax calculator can estimate your property taxes. What Is The Property Tax Rate In Pinal County Az.

From mentorsmoving.com

Pinal County Property Tax Guide 💰 Assessor, Portal, Records, Search What Is The Property Tax Rate In Pinal County Az The median property tax (also known as real estate tax) in pinal county is $1,383.00 per year, based on a median home value of $164,000.00. The pinal county treasurer's office is dedicated to providing easily accessible tax information and resources to better help taxpayers understand the collection, distribution, and. What property tax information are you looking for? The rates are. What Is The Property Tax Rate In Pinal County Az.

From www.pinal.gov

Parcel Map Viewer Pinal County, AZ What Is The Property Tax Rate In Pinal County Az The pinal county treasurer's office is dedicated to providing easily accessible tax information and resources to better help taxpayers understand the collection, distribution, and. Our primary mission is to locate, identify and appraise at current market value, locally assessed property in pinal county for ad valorem tax purposes (taxation based on the value of property). The median property tax (also. What Is The Property Tax Rate In Pinal County Az.

From vinitawrena.pages.dev

Tax Brackets 2024 Arizona State Cele Meggie What Is The Property Tax Rate In Pinal County Az The rates are given per $100 net. What property tax information are you looking for? Our primary mission is to locate, identify and appraise at current market value, locally assessed property in pinal county for ad valorem tax purposes (taxation based on the value of property). The median property tax (also known as real estate tax) in pinal county is. What Is The Property Tax Rate In Pinal County Az.

From roselawgroupreporter.com

Pinal County's primary tax rate cut 4 cents Rose Law Group Reporter What Is The Property Tax Rate In Pinal County Az Our primary mission is to locate, identify and appraise at current market value, locally assessed property in pinal county for ad valorem tax purposes (taxation based on the value of property). The median property tax (also known as real estate tax) in pinal county is $1,383.00 per year, based on a median home value of $164,000.00. Our pinal county property. What Is The Property Tax Rate In Pinal County Az.